Homebuying will shift from large urban centers to suburban communities, according to UCLA’s latest Anderson Economic Forecast.

And it’s beginning to play out in Irvine. “People are resetting their priorities with this pandemic,” says John Shumway, principal economist for the Concord Group. “And all the amenities that Irvine offers are at the top of the list.”

That’s driving value. Irvine’s villages of Portola Springs and Orchard Hills, for example, have seen increased demand. Home sales in Irvine have recovered their pace since March and April, and even surpassed year-over- year numbers in June and July.

“Our homebuyer surveys tell us Irvine’s parks, ranked No. 1 in California, and its reputation as America’s safest city mean a lot to buyers,” says Tom Veal, vice president of sales and marketing for homebuilding company Irvine Pacific.

Education is also a key driver. “Irvine Unified School District’s long-term success is unmatched,” Veal says.

“This stability is reassuring to buyers during these times of uncertainty.”

Irvine’s outdoor lifestyle

Valerie Bozich still recalls the day she and her husband, both of Chicago, found their Orchard Hills home.

“The weather and lifestyle were like nothing we ever imagined,” says Bozich, a financial planner. “The homes felt as if they were nestled within nature.”

Every day, she steps out her front door onto a trail that skirts a nearby reservoir and hills of avocado orchards with views clear to Catalina Island.

“I run a 3 1/2 mile trail daily, and all that nature quiets my mind,” she says. “We’ve decided we want to stay here forever.”

Lowest rates on record

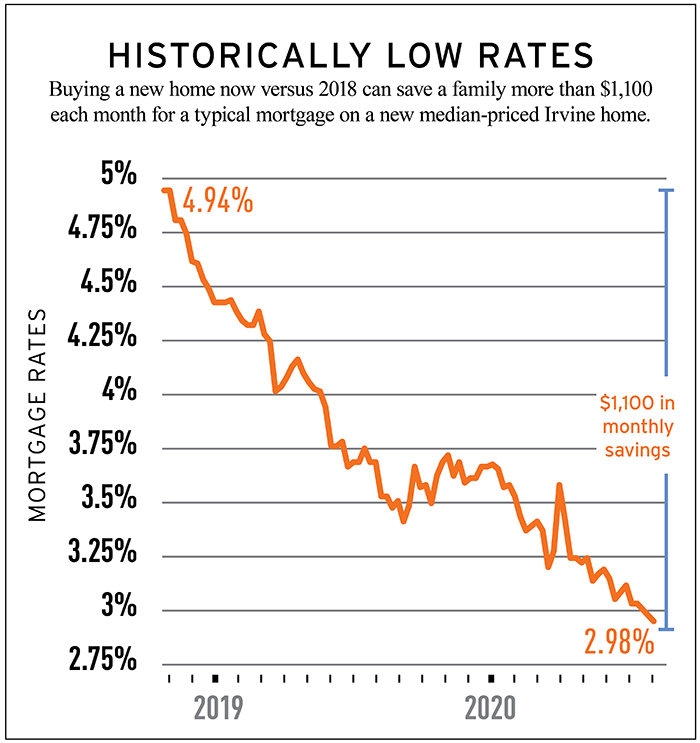

Mortgage rates made history last month, as the average rate dipped below 3% for a 30-year, fixed-rate loan. It marked a first for Freddie Mac, the government-backed mortgage lender, which began tracking averages in 1971.

“The drop has led to increased home-buyer demand,” says Sam Khater, chief economist for Freddie Mac.

When compared with July 2018 rates, today’s averages amount to about $1,100 in monthly savings for a typical 30-year, fixed-rate mortgage in Irvine – more than $13,000 a year.