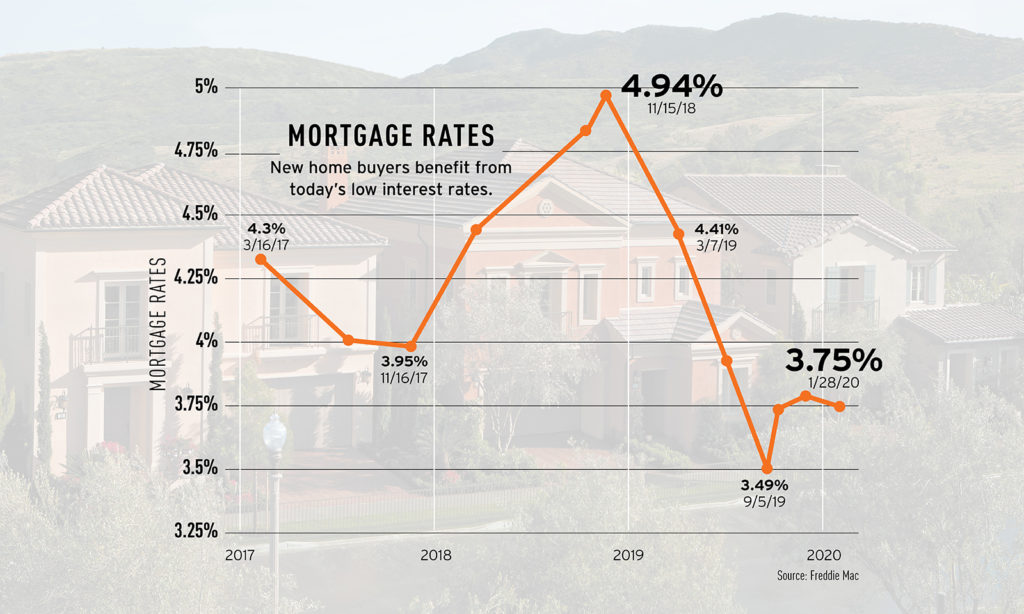

Those record-low interest rates you’ve been hearing about? Economists predict they’ll stay under 4% through the first quarter of 2020.

Those record-low interest rates you’ve been hearing about? Economists predict they’ll stay under 4% through the first quarter of 2020.

The Fed’s unanimous vote to leave interest rates low – combined with low inflation – will keep rates down, according to Bankrate Chief Financial Analyst Greg McBride.

“Inflation remains tame and long-term rates are settling, pulling mortgage rates down just a bit,” he said in January.

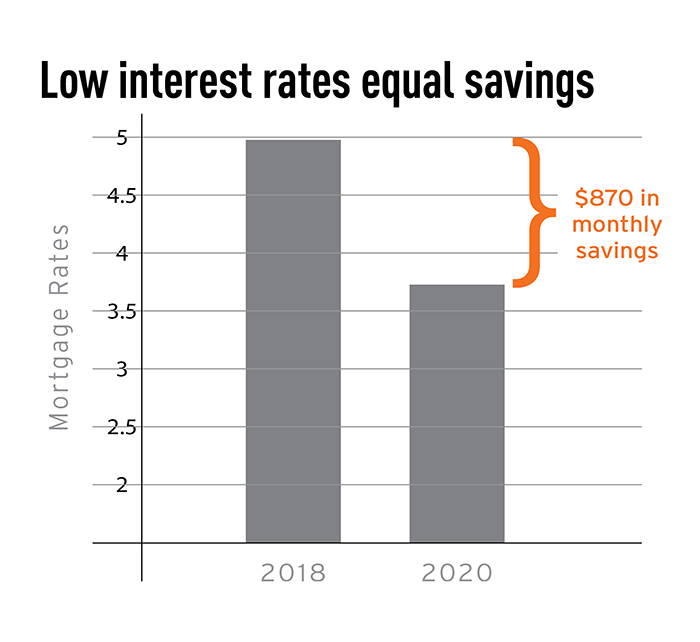

Understanding the impact of mortgage interest rates can mean a lot to an Irvine family’s pocketbook. In fact, a family could save hundreds of dollars each month by purchasing a new home now compared to this time in 2018, when mortgage rates were at around 5%.

The question then becomes, “Is now the right time to buy?” The numbers suggest that the answer is yes.

When interest rates dropped to historic lows in December, they drove up Orange County home sales by 32% over year-ago levels, according to the California Association of Realtors.

And for good reason.

Interest rates now hover around 3.75% for a 30-year mortgage. That’s a drop of more than 125 basis points from their peak in 2018. That difference saves buyers about $870 each month on a new median-priced Irvine home – more than $250,000 over the life of the loan.