Irvine anesthesiologist Thomas Lee leads an angel investment committee that evaluates promising medical technology startups – and there are so many seeking meetings that he keeps getting overbooked.

“Medtech is exploding in Irvine,” Lee says. “I thought it was hot and vibrant when I joined the committee in 2015, but it has only become more robust.”

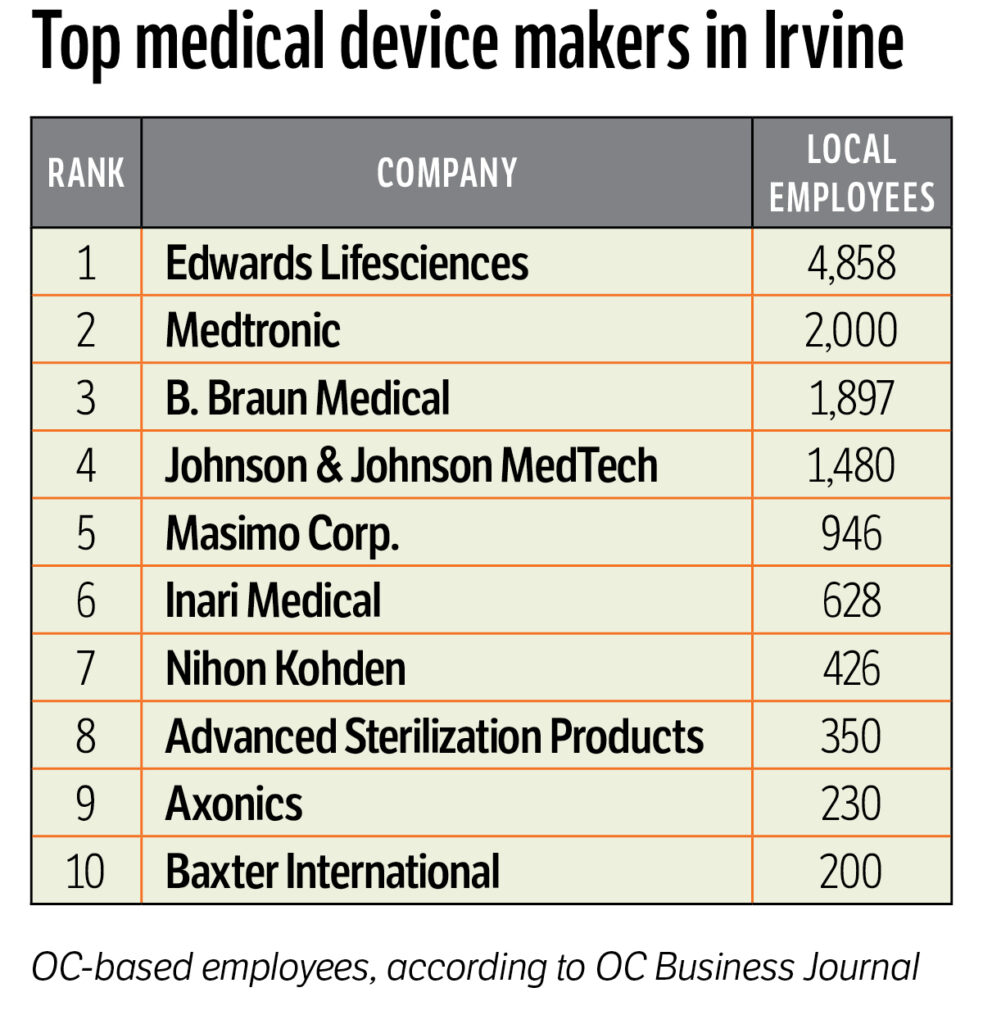

“Medtech” – from heart valves to artificial-intelligence strategies that help diagnose and treat disorders – is one of Irvine’s strongest industries, according to Lee and other experts. With hundreds of firms providing thousands of jobs and billions of dollars in revenue, it’s anchored by giant, long-established local businesses, including Edwards Lifesciences, Medtronic Neurovascular, Masimo and Allergan (now part of AbbVie), as well as relative newcomer powerhouses, including Axonics, InMode and Inari Medical.

“We have a wonderful ecosystem in Irvine in which people can begin their careers, grow their careers, carry their experiences from organization to organization and provide constant innovation to the industry,” says Medtronic Executive Vice President Brett Wall, who is also president of the firm’s Neuroscience Portfolio at UCI Research Park.

The ‘family tree’ of medtech innovators

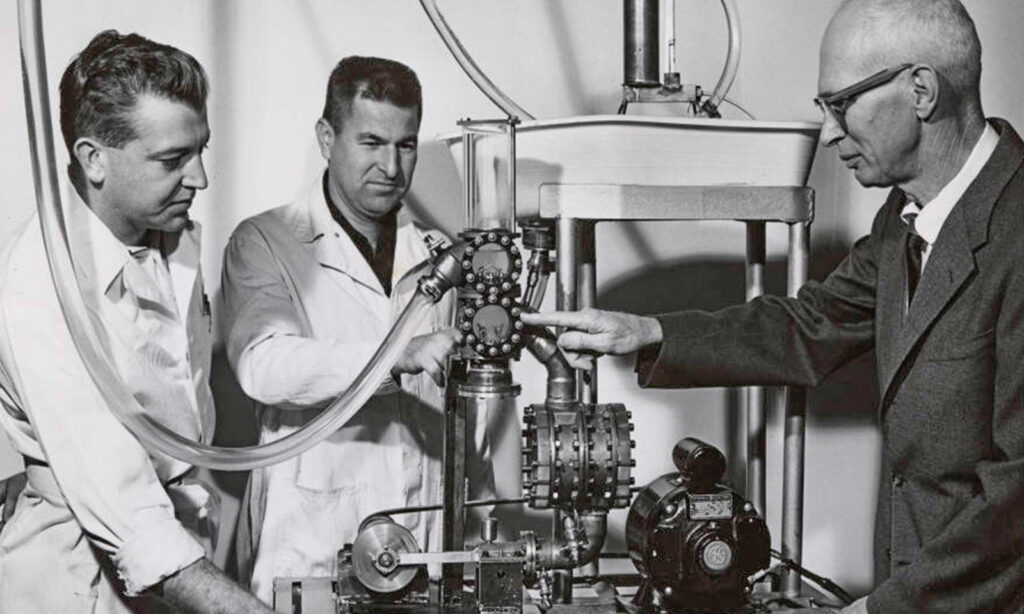

The origin of Irvine’s medtech boom stretches back to the 1960s, when Miles Edwards, inventor of the world’s first artificial heart valve, moved his new company here. Over the next half-century, the upstart medical device company evolved into Edwards Lifesciences, a $50 billion global leader in cardiac medical devices and a progenitor of dozens of related smaller firms.

Longtime medtech investor Don Milder years ago was so impressed by the number of Edwards employees who later started their own companies that he drew a “family tree” showing Edwards as the parent of more than 40 startups that in many cases thrived before being bought up by bigger firms, including Edwards.

“The reason there’s such a medtech concentration today dates to those guys at Edwards who identified great talent and attracted it and nurtured it,” Milder says. “Their employees learned how to develop products, went out and did their own thing, and created the critical mass of activity needed for a self-sustaining industry.”

‘Win-win’ for companies and Irvine

‘Win-win’ for companies and Irvine

As the medtech firms multiplied, Irvine’s Master Plan, unveiled in the 1960s, supplied key infrastructure, beginning with UC Irvine, and over time a trove of premier office space and industrial parks.

“Irvine developed everything these companies needed, which turned out to be a win-win for the companies and for Irvine,” Milder says. Medtech entrepreneurs also appreciate the city’s pro-innovation culture, which includes incubators, accelerators, highly motivated investors and ancillary supports, including patent lawyers and prototype labs.

“There are few other places in the country where you can see this level of community cooperation and ingenuity,” Lee says.

The fomenting of new medtech companies and products in Irvine could accelerate in the near future as three Irvine health centers – Hoag, City of Hope and UCI – invest more than $4 billion in medical facilities.

“This will really help push the medtech industry forward,” predicts Lee, who says the new investments should attract more talent and expertise to help new startups flourish. “It’s one more testament to the confidence investors have in Irvine’s medtech ecosystem.”